Foreign currency etf basket

ETFs have opened up the doors to previously hard-to-reach corners of the market, including foreign equities, commodities and alternative asset classes. Currency ETFs in particular have seen growing interest among investors and traders alike as they greatly simplify the challenges associated with entering the forex market [see How To Take Profits And Cut Losses When Trading ETFs ].

Currency ETFs attempt to replicate the movements of a currency on the foreign exchange market forex against the U. This is done by using cash deposits, such as holding euros or Swiss cash, or through the use of futures and swap contracts to achieve a desired exposure [see ETF Lessons Every Financial Advisor Should Learn ].

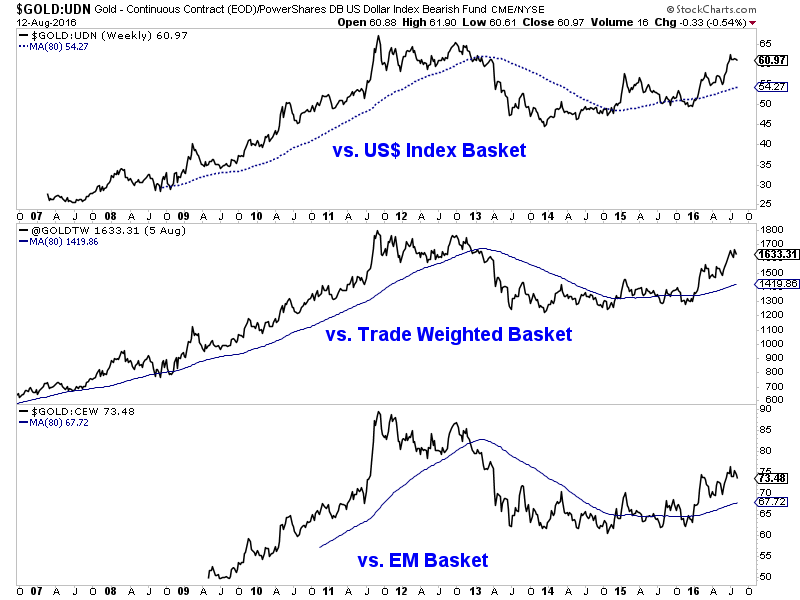

If you believe the euro, other active global currency, or a basket of currencies will rise or fall relative to the USD , currency ETFs provide a way to capitalize on that. There are two main types of currency ETF products: A currency basket ETF on the other hand, such as the Dreyfus Emerging Currency Fund CEW A , invests in multiple currencies relative to the USD. In this case, the ETF will increase in value if these currencies on average perform better than the USD [see King Dollar ETFdb Portfolio ].

Ticker Currency Expense Ratio FXE A Euro 0. Ticker Basket Expense Ratio Strategy UUP A United States Dollar Bullish vs. CEW A Emerging Currency 0. DBV A- G10 Currency Harvest 0. CCX B- Commodity Currency 0. ICI C Currency Carry 0.

AYT B- Asia 8 0.

Currency ETF List, Screener & News | qoxoxoxiqel.web.fc2.com

The different products offer varying risk and opportunity levels, and provide a wide range of exposure to different currencies. At times, these baskets of currencies can be very volatile if affected by a regional event or news. One type of product is not better than the other, but each investor must thoroughly critique what they are seeking, and the risks they can accept, before deciding which product is the right fit.

The currency markets allow global commerce to run smoothly, facilitating the transfer of products and services from one place to another. Interest rate and Federal Reserve announcements, as well as economic data releases, typically have the largest impact in this regard.

In the moments before and after these announcements hit the market, expect increased volatility and wider bid-ask spreads in the currency ETFs you are trading.

Keep in mind that the news event affecting one currency or country may affect other currencies as well — even those that are seemingly unrelated. Therefore, news events such as those discussed in the next section are noteworthy when released by any major country, and the names of releases may vary by country. Locate an economic calendar that shows all news and data reports scheduled for release in each country to stay on top of news that may affect your currency ETF.

Many of these calendars rate the news events, from high to low, according to the expected market impact. Federal Reserve or Central Bank announcements News releases from banking committees, financial bodies such as treasuries, or reserve banks relating to interest rates or economic outlooks can shift perception and are widely watched and traded. Consumer or Product Price Index CPI , PPI These indexes provide inflation data and therefore offer clues as to interest rate direction, affecting the short- and long-term direction in currencies.

Gross Domestic Product GDP This is an indicator of how a country is doing economically and therefore provides valuable fundamental data to currency traders. Policymaker Speeches Talks by people in power, such as heads of state, Federal Reserve s or Treasury departments can sway markets based on their bullish or bearish comments.

Manufacturing and Construction Data Looks at growth or contraction in the manufacturing sector; an indicator of economic health. Trade Balance, Balance of Payments, Current Account and Debt Levels Numbers that reflect economic health, growth or contraction, which have long-term effects on the supply and demand of a currency.

ETFs listed on the American markets will be active during the U. Since currency ETFs are thinly traded outside of U. S hours as sharp movements can occur to bring the ETF back in line with its NAV net asset value , or large orders may cause a significant deviation from NAV [see 7 Rules ETF Day Traders Must Know ]. As with any trading vehicle, use stop-loss orders to control downside risk. Incorporate limit orders into your trading in an attempt to get favorable pricing during peak and off-peak trading times, and take profits using a disciplined technique as currencies can be volatile and change direction quickly.

Currency ETFs provide a convenient way for investors to access the forex market through their current stockbroker. Currency ETFs can be divided into two broad categories: Each provides unique advantages and disadvantages. Currencies can be volatile due to high speculation and sensitivity to news; as such, closely monitor global news, both scheduled and unscheduled, to stay on top of short- and long-term events that can shape future trends.

Always monitor downside risk, and take profits when profit potential looks to be waning. Every week, we bring you the best and most succinct curation of must-read articles to help you Get the latest ETF news, analysis, and commentary from the independent authority on ETFs.

Subscribe to the ETFdb. Low Volatility ETFs invest in securities with low volatility characteristics. These funds tend to have relatively stable share prices, and higher than average yields.

Investors who suspect that the stock market may be about to decline can take action to reduce the Thank you for selecting your broker. Please help us personalize your experience.

Your personalized experience is almost ready. Join other Individual Investors receiving FREE personalized market updates and research.

Top 33 Currency ETFs

Join other Institutional Investors receiving FREE personalized market updates and research. Join other Financial Advisors receiving FREE personalized market updates and research. Check your email and confirm your subscription to complete your personalized experience. Thank you for your submission, we hope you enjoy your experience. Pricing Free Sign Up Login. Cory Mitchell Jun 24, The table below lists the currency-specific exchange-traded-products ETPs.

No positions at time of writing. Get Email Updates Subscribe to receive FREE updates, insights and more, straight to your inbox. Practice Management 3 Must-Read Pieces for Practice Management: June 20 Edition Kristan Wojnar Jun 20, News Buy on the Dip Prospects: June 19 Edition Sam Bourgi Jun 19, Below is a look at ETFs that currently offer attractive buying opportunities.

News Sell on the Pop Prospects: Here is a look at ETFs that currently offer attractive short selling opportunities. Tools ETF Screener ETF Analyzer Mutual Fund to ETF Converter Head-To-Head ETF Comparison ETF Country Exposure Tool ETF Stock Exposure Tool ETF Performance Visualizer ETFdb.

TrimTabs Going International With Free Cash Flow ETFExplore ETFs ETF Picks of the Month ETF Category Reports Premium Articles Monthly Newsletter Alphabetical Listing of ETFs Best ETFs Browse ETFs by ETFdb. Legal Privacy Policy Terms of Use Follow ETFdb.

Actionable ETF Investment Ideas Analysis of Every New ETF ETF News and Head-to-Head Comparisons. We Respect Your Privacy.

Is your portfolio protected for what the markets will bring this fall? Creating a properly diversified portfolio can be a difficult proposition, especially when ETF Investing Low Volatility ETF List Low Volatility ETFs invest in securities with low volatility characteristics.

ETF Investing 10 ETFs for Risk Reduction in Your Portfolio Bob Ciura. Buys only USD futures contracts relative to other major currencies basket. Goes long futures in highest G10 interest rate currencies, and short futures in the lowest interest rate currencies. Invests in high-yielding G10 currencies by borrowing in low-yielding G10 currency markets—carry trade.