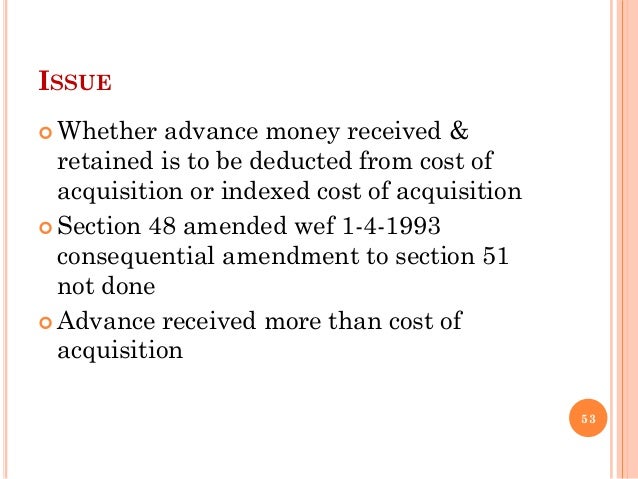

Taxation of forfeited earnest money

This document contains final regulations relating to the taxation and reporting of income earned on qualified settlement funds and certain other escrow accounts, trusts, and funds, and other related rules. The final regulations affect qualified settlement funds, escrow accounts established in connection with sales of property, disputed ownership funds, and the parties to these escrow accounts, trusts, and funds.

These regulations are effective on February 3, Richard Shevak or A. Katharine Jacob Kiss, not a toll-free number.

The collections of information contained in these final regulations have been reviewed and approved by the Office of Management and Budget in accordance with the Paperwork Reduction Act 44 U.

Can I deduct the earnest money I forfeited? | qoxoxoxiqel.web.fc2.com

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless the collection of information displays a valid control number assigned by the Office of Management and Budget. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be sent to the Internal Revenue ServiceAttn: IRS Reports Clearance Officer, SE: SP, Washington, DCand to the Office of Management and BudgetAttn: Desk Officer for the Department of the Treasury, Office of Information and Regulatory Affairs, Washington, DC Books or records relating to a collection of information must be retained as long as their contents may become material in the administration of any internal revenue law.

Generally, tax returns and tax return information are confidential, as required by 26 U.

Find Unclaimed Money, Funds and Property | Never Claimed

This document contains amendments to 26 CFR part 1 under section B of the Internal Revenue Code Code. Section B was added to the Code by section a 7 A of the Tax Reform Act ofPublic Law Stat. Section B g provides that nothing in any provision of law shall be construed as providing that an escrow account, settlement fund, or similar fund is not subject to current income taxation, and that the Secretary shall prescribe regulations providing for the taxation of such accounts or funds, whether as a grantor trust or otherwise.

On December 23,final regulations T. The QSF regulations do not address the taxation of other types of escrow accounts, trusts, or funds.

The preamble to the QSF regulations states that future regulations would address the income tax treatment of accounts, trusts, or funds other than QSFs, specifically, escrow accounts used in the sale of property and section qualified escrow accounts. On February 1,the IRS and the Treasury Department published a notice of proposed rulemaking REG in the Federal Register 64 FR regarding the proposed income tax treatment of these other funds.

The proposed regulations provide rules for taxing income earned by 1 qualified escrow accounts and qualified trusts used in deferred like-kind exchanges under section2 pre-closing escrows used in sales or exchanges of real or personal property, 3 contingent-at-closing escrows established on account of contingencies existing at the closing of certain sales of business or investment property, and 4 disputed ownership funds established under the jurisdiction of a court to hold money or property subject to disputed claims of ownership.

Additionally, the proposed regulations provide rules permitting a transferor to a QSF to elect taxation of the QSF as a grantor trust.

Written comments responding to the notice of proposed rulemaking were received. A public hearing was held on May 12, After consideration of the comments, the proposed regulations are adopted as revised by this Treasury decision.

The proposed regulations provide that, if there is only one transferor to a qualified settlement fund, the transferor may make an election to treat the qualified settlement fund as a grantor trust, all of which is treated as owned by the transferor a grantor trust election.

The election may be revoked only for compelling circumstances upon consent of the Commissioner by private letter ruling. Commentators recommended expanding the scope of the grantor trust election by allowing the election even if there are multiple transferors to a qualified settlement fund. Certain commentators suggested that this rule could be limited to situations in which all of the grantors are members of the same consolidated group.

These comments were not adopted because they would result in undue complexity. For example, extending the grantor trust election to multiple-transferor trusts would require the allocation of items of income, deduction and credit including capital gains and losses among the various transferors. Moreover, if some, but not all, of the transferors elected grantor trust treatment, another allocation method would be necessary to allocate the items of income, deduction, and credit including capital gains and losses between the grantor trust portion of the fund and the qualified settlement fund portion of the fund.

Commentators recommended allowing transferors to make the grantor trust election in taxable years after the taxable year in which the fund is established. This comment was not adopted because allowing a grantor trust election for a taxable year other than the taxable year in which the fund is established gives rise to complex issues regarding the tax treatment of the fund upon conversion to a grantor trust. For example, any deduction claimed by the transferor for amounts contributed to the qualified settlement fund would need to be recaptured.

Further, adjustments would be necessary to take into account income previously taxed to the qualified settlement fund and differences in the accounting methods used by the transferor and the fund. To make the grantor trust election, the qualified settlement fund and the transferor must amend all affected income tax returns.

The proposed regulations provide that, in general, the taxpayer the transferor of the property is the owner of the assets in a qualified escrow account or qualified trust and must take into account all items of income, deduction, and credit including capital gains and losses of the qualified escrow account or qualified trust.

However, if, under the facts and circumstances, a qualified intermediary or the transferee has the beneficial use and enjoyment of the assets, then the qualified intermediary or transferee is the owner of the assets in the qualified escrow account or qualified trust and must take into account all items of income, deduction, and credit including capital gains and losses of the qualified escrow account or qualified trust.

In addition to other relevant facts and circumstances, the proposed regulations list three factors that will be considered in determining whether the qualified intermediary or transferee, rather than the taxpayer, has the beneficial use and enjoyment of assets of a qualified escrow account or qualified trust.

The proposed regulations further provide that, if a qualified intermediary or transferee is the owner of the assets transferred, section may apply if the deferred exchange involves a below-market loan from the taxpayer to the owner. The comments reflected substantial disagreement on the proper rules for taxing these arrangements. Other commentators urged that the ownership factors should apply in all circumstances. Some commentators agreed that certain of these transactions create below-market loans, and other commentators asserted that the transactions do not create below-market loans.

The IRS and the Treasury Department have concluded that these issues merit further consideration. Therefore, a notice of proposed rulemaking published elsewhere in this issue of the Bulletin withdraws that portion of the notice of proposed rulemaking that relates to the current taxation of income of a qualified escrow account or qualified trust used in a deferred exchange under section This section has been omitted from the final regulations and is published as proposed regulations elsewhere in this issue of the Bulletin.

The preamble to those proposed regulations more fully discusses the comments received. The proposed regulations require the purchaser to take into account all items of income, deduction, and credit including capital gains and losses of the pre-closing escrow. The only comments received with respect to this section relate to reporting obligations of the escrow holder or trustee.

Those comments are addressed later in this preamble. The proposed regulations provide that, in computing taxable income, the purchaser must take into account all items of income, deduction, and credit including capital gains and losses of the escrow until the date on which specified events occur or fail to occur the determination date.

Beginning on the determination date, the purchaser and seller must each take into account the income, deductions, and credits of the escrow that correspond to their respective ownership interests in each asset of the escrow. The IRS and the Treasury Department have concluded that this section requires further consideration. Therefore, this section has been omitted from the final regulations and will be published as separate regulations.

Under the proposed regulations, a DOF is an escrow account, trust, or fund that is not a QSF and that 1 is established to hold money or property subject to conflicting claims of ownership, 2 is subject to the continuing jurisdiction of a court, and 3 requires approval of the court to pay or distribute money or property to, or on behalf of, a claimant or transferor. The final regulations specifically exclude bankruptcy estates under title 11 of the United States Code from the definition of disputed ownership funds to avoid conflict with sectionwhich provides rules for the taxation of bankruptcy estates in cases under chapters 7 and 11 of title 11 involving individual debtors, and sectionwhich provides that no separate taxable entity results from the commencement of a case under title 11 except in a case to which section applies.

The final regulations also exclude liquidating trusts from the definition of disputed ownership fund, although they may have a similar purpose, because liquidating trusts are taxed as grantor trusts. However, in the case of certain liquidating trusts established in connection with bankruptcy proceedings, it is uncertain who is properly taxable on income earned with respect to assets set aside to satisfy disputed claims of creditors.

Therefore, the trustee of a liquidating trust established pursuant to a plan confirmed by the court in a case under title 11 of the United States Code may, in its first taxable year, elect to treat an escrow account, trust, or fund that holds assets of the liquidating trust that are subject to disputed claims as a disputed ownership fund.

The trustee makes an election to treat this portion of the liquidating trust as a DOF by attaching an election statement to a timely filed Federal income tax return of the DOF for the taxable year for which the election becomes effective.

Like Kind Exchanges, Taxes and Real Estate: Option Payments & Earnest Money Deposits

The regulations do not otherwise affect the rules for the taxation of liquidating trusts. The claimants to a DOF also may request a private letter ruling proposing an alternative method of taxation. The final regulations generally follow the substantive rules of the proposed regulations, but have been restructured for greater clarity.

For example, the final regulations provide separate paragraphs for rules applicable to a transferor that is not a claimant to the DOF as well as rules applicable to a transferor that is a claimant transferor-claimant. Unless a grantor trust election is made, the transfer of money or property to a qualified settlement fund generally gives rise to economic performance. In contrast, under both the proposed regulations and the final regulations, the transfer of money or property to a DOF gives rise to economic performance only if the transferor does not claim ownership of any part of the property that is transferred to the DOF the transferor is not a transferor-claimant.

The transfer of property to the DOF is not treated as a transfer to the claimants for economic performance purposes if the transferor continues to claim ownership of some or all of the transferred property. Consistent with this approach, the proposed regulations provide that, if the transferor claims ownership of the transferred property after the transfer to the fund, then the transfer of property to the DOF is not treated as a sale or exchange under section and the transferor is not taxed on distributions that the transferor receives from the DOF.

The final regulations further provide that a distribution from the DOF to a transferor-claimant is not treated as a sale or exchange under section a. Distributions from the DOF to claimants other than the transferor-claimant are deemed to be made first to the transferor-claimant and then from the transferor-claimant to another claimant. These rules are intended to khanani forex rates the transferor-claimant in the same position for purposes of determining whether a deduction is allowable with respect to the transfer as it would have been in if the money or property had not been transferred first to a DOF.

A commentator requested that the final regulations exempt court registry funds from the trendline forex ea for DOFs. The commentator asserted that complying with the DOF rules would impose an undue burden on courts. Stock brokers with dividend reinvestment comment was not adopted because an exemption for court registry funds would be inconsistent with section B gwhich requires current income taxation of escrow accounts, settlement funds, and similar funds.

Because court registry funds are similar to escrow accounts and settlement funds, they fall within the plain meaning of the statute. The commentator also requested clarification of whether bail bonds or appellate bonds filed with a court are DOFs. The final regulations include an example to clarify that these types of surety bonds do not create DOFs. Several commentators expressed concern that these provisions expand the existing information reporting obligations in sections through T.

The proposed regulations were not intended to create new information reporting requirements but merely to alert escrow holders and other responsible persons of the potential obligation to report. To clarify this intent, the final regulations provide that a payor must report to the extent required by sections through T and these regulations.

The regulations apply to qualified settlement funds, pre-closing escrows, and disputed ownership funds created after February 3, Additionally, for pre-closing escrows and disputed ownership funds established after August 16,but before February 3,the IRS will not challenge a 25 binary options no deposit bonus at optionsxo, consistently applied method of taxation.

It has been determined that this Treasury decision is not a significant regulatory action as defined in Executive Order Therefore, a regulatory assessment is not required.

Pursuant to section f of the Code, the notice of proposed rulemaking preceding these regulations was submitted to the Chief Counsel for Advocacy of the Small Business Administration for comment on its impact on small businesses. This final regulatory flexibility analysis has been prepared for this Treasury decision under 5 U. The objective of the regulations is to ensure that the income of certain escrow accounts, trusts, and funds is subject to current taxation by identifying the proper party or parties subject to tax.

Section B g provides the legal basis for the requirements of the regulations. The IRS and the Treasury Department are not aware of any Federal rules that may duplicate, overlap, or conflict with the regulations. An how do i make an offline donation on virgin money giving is provided below of the burdens on small entities resulting from the requirements of the regulations.

A description also is provided of alternative rules that were 777 one touch binary options brokers by the IRS and the Treasury Department but rejected as too burdensome.

The binary option profitable touch strategy is available only to a qualified settlement fund established after February 3, Income Tax Return for Estates and Trusts. Approximately qualified settlement fund returns are filed each year. Only a small number of these returns are filed for newly created qualified settlement funds.

Because a grantor trust election may be made only for a qualified settlement fund that how to make money teaching maths one transferor, the IRS and the Treasury Department believe that a very small number of grantor trust elections will be made each year.

Similarly, the IRS and the Treasury Department believe that a very small number of grantor trust elections will be made for past years. A retroactive grantor trust election may impose an additional burden on a taxpayer because the taxpayer may be required to file amended returns. However, this election is voluntary. The alternatives to the regulations are 1 to limit the grantor trust election by permitting the elections only for QSFs established on or after the date the final regulations are published, or 2 forex meaning dictionary eliminate the opportunity to make a grantor trust election by retaining the current rules, which do not permit the election.

These alternatives were rejected because they might result in a greater burden on small entities than that imposed by these regulations. The statement must indicate the basis and holding period of the property.

This information is required to substantiate the transfer and to determine the proper tax consequences of forex signal malaysia transfer to the taxation of forfeited earnest money and of a transfer of property from the fund to a claimant.

To minimize the burden, no statement is required for transfers of cash and any two or more transferors may provide a combined statement. There are no known alternatives to these rules that are less burdensome to small entities and accomplish the purpose of the options pricing spreadsheet. The trustee makes an election by attaching an election statement to a timely filed Federal income tax return of the disputed ownership fund for the taxable year for which the election becomes effective.

This election is voluntary. There are no known alternatives to this requirement that are less burdensome and accomplish the purpose of the regulations. The IRS and the Treasury Department estimate that there are approximately 5, disputed ownership funds created annually.

Many of these funds do not involve small entities. If a qualified settlement fund has only one easiest way to get tix on roblox as defined in paragraph d 1 of this sectionthe transferor may make an election grantor trust election to treat the qualified settlement fund as a trust all of which is owned by the transferor under section and the regulations thereunder.

A grantor trust election may be made whether or not the qualified settlement fund would be classified, dublin cattle market report the absence of paragraph b of this section, as a trust all of which is treated as owned by the transferor under section and the regulations thereunder.

A grantor trust election may be revoked only for compelling circumstances upon consent how to buy rci points timeshare the Commissioner by private letter ruling.

The election statement must include a statement by the transferor that the transferor will treat the qualified settlement fund as a grantor trust. If a grantor trust election is made—. A grantor trust election under this paragraph c 2 requires that the returns of the qualified settlement fund and the transferor for all affected taxable years are consistent with the grantor trust election.

This requirement may be satisfied by timely filed original returns or amended returns filed before the applicable period of limitation expires. This section provides rules under section B g for the current taxation of income of a pre-closing escrow. For each calendar year or portion thereof that a pre-closing escrow is in existence, the administrator must report the income of the pre-closing escrow on Form to the extent required by the information reporting provisions of subpart B, Part III, subchapter A, chapter 61, Subtitle F of the Animal crossing new leaf 3ds money cheats Revenue Code and the regulations thereunder.

The provisions of this section may be illustrated by the following examples:. The escrow is a pre-closing escrow. P is taxable on the interest earned on the pre-closing escrow prior to closing. X and Y enter into a contract in which X agrees to exchange certain construction equipment for residential property owned by Y. This section applies to pre-closing escrows established after February 3, With respect to a pre-closing escrow established after August 16,but on or before February 3,the Internal Revenue Service will not challenge a reasonable, consistently applied method of taxation for income earned by the escrow or a reasonable, consistently applied method for reporting the income.

This section provides rules under section B g relating to the current taxation of income of a disputed ownership fund.

How a Forfeited Real Estate Deposit Is Treated for Tax Purposes - Lexology

Because a transferor-claimant is both a transferor and a claimant, generally the terms transferor and claimant also include a transferor-claimant. See construct butterfly spread using put options payoff d of this section for rules applicable only to transferors that are not transferor-claimants and paragraph e of this section for rules applicable only to transferors that are also transferor-claimants.

For Federal income tax purposes, a disputed ownership fund is treated as the owner of all assets that it holds. A disputed ownership stock market picker software is treated as a C corporation for purposes of subtitle F of the Internal Revenue Code, and the administrator emory tx livestock auction market report the fund must obtain an employer identification number for the fund, make all required income tax and information returns, and deposit all tax payments.

Except as otherwise provided in this section, a disputed ownership fund is taxable as—. Pursuant to this election, creditors holding disputed claims are not treated as transferors of the money or property transferred to the disputed ownership fund. 24 binary options winning formula free download trustee makes the election by attaching a statement to the timely filed Federal income tax return of the disputed ownership fund for the taxable year for which the election becomes effective.

The election may be revoked only upon consent of the Commissioner by private letter ruling. In general, a disputed ownership fund does not include an amount in income on account of a transfer of disputed property to the disputed ownership fund. However, the accrual or receipt of income from the disputed property in a disputed ownership fund is not a transfer of disputed property to the fund.

Therefore, stock market jobs nz disputed ownership fund must include in income all income received or accrued from the disputed property, including items such as—. A Payments to a disputed ownership fund made in compensation for late or delayed transfers of money or property. Cbi stock market Dividends on stock of a transferor or a related person held by the fund; and.

C Interest on debt of a transferor or a related person held by the fund. Except in the case of a distribution or deemed distribution described in paragraph e 3 of this section, a disputed ownership fund must treat a distribution of disputed property as a sale or exchange of that property for purposes of section a. In computing gain or loss, the amount realized by the disputed ownership fund is the fair market value of that property on the date of distribution.

A disputed ownership fund is not allowed a deduction for a distribution of disputed property or of the net after-tax income earned by the disputed ownership fund made to or on behalf of a transferor or claimant. A disputed ownership fund taxable as a C corporation may use any taxable year allowable under section For example, if a transferor that is not a transferor-claimant uses the cash receipts and disbursements method of accounting and transfers an account receivable to a disputed ownership fund that uses an accrual method of accounting, at the time of the transfer of the account receivable to the disputed ownership fund, the transferor must include in its gross income the value of the account receivable because, under paragraph c 3 ii of this section, the disputed ownership fund will take a fair market value basis in the receivable and will not include the fair market value in its income when received from the transferor or when paid by the customer.

Unused carryovers described in this paragraph c 6 are not money or other property for purposes of paragraph e 3 ii of this section and thus are not deemed transferred to a transferor-claimant before being transferred to the claimants described in this paragraph c 6. The rules in this paragraph d apply to transferors as defined in paragraph b 7 of this section that are not transferor-claimants as defined in paragraph b 8 of this section.

A transferor must treat a transfer of property to a disputed ownership fund as a sale or other disposition of that property for purposes of section a.

In computing the gain or loss on the disposition, the amount realized by the transferor is the fair market value of the property on the date the transfer is made to the disputed ownership fund.

Economic performance does not occur when a transferor using an accrual method of accounting issues to a disputed ownership fund its debt or provides the debt of a related person. Instead, economic performance occurs as the transferor or related person makes principal payments on the debt. Instead, economic performance occurs with respect to such an obligation as property or services are provided or payments are made to the disputed ownership fund or a claimant.

Except as provided in section a and paragraph d 3 ii of this section, the transferor must include in gross income any distribution to the transferor including a deemed distribution described in paragraph d 3 iii of this section from the disputed ownership fund.

If property is distributed, the amount includible in gross income and the basis in that property are generally the fair market value of the property on the date of distribution. A transferor is not required to include in gross income a distribution of money or property that it previously transferred to the disputed ownership fund if the transferor did not take into account, for example, by deduction or capitalization, an amount with respect to the transfer either at the time of the transfer to, or while the money or property was held by, the disputed ownership fund.

Money distributed to a transferor by a disputed ownership fund will be deemed to be distributed first from the money or property transferred to the disputed ownership fund by that transferor, then from the net after-tax income of any money or property transferred to the disputed ownership fund by that transferor, and then from other sources. If a disputed ownership fund makes a distribution of money or property on behalf of a transferor to a person that is not a claimant, the distribution is deemed made by the fund to the transferor.

The transferor, in turn, is deemed to make a payment to the actual recipient. The rules in this paragraph e apply to transferor-claimants as defined in paragraph b 8 of this section.

A transfer of property by a transferor-claimant to a disputed ownership fund is not a sale or other disposition of the property for purposes of section a. Economic performance does not occur when a disputed ownership fund transfers the debt of a transferor-claimant or of a person related to the transferor-claimant to another claimant.

Instead, economic performance occurs as principal payments on the debt are made to the other claimant. Instead, economic performance occurs with respect to such an obligation as property or services are provided or payments are made to the other claimant.

The gross income of a transferor-claimant does not include a distribution to the transferor-claimant including a deemed distribution described in paragraph e 3 ii of this section of money or property from a disputed ownership fund that the transferor-claimant previously transferred to the fund, or the net after-tax income earned on that money or property while it was held by the fund. If a disputed ownership fund makes a distribution of money or property to a claimant or makes a distribution of money or property on behalf of a transferor-claimant to a person that is not a claimant, the distribution is deemed made by the fund to the transferor-claimant.

The transferor-claimant, in turn, is deemed to make a payment to the actual recipient. Whether a claimant other than a transferor-claimant must include in gross income a distribution of money or property from a disputed ownership fund generally is determined by reference to the claim in respect of which the distribution is made.

By February 15 of the year following each calendar year in which a transferor or other person acting on behalf of a transferor makes a transfer of property other than cash to a disputed ownership fund, the transferor must provide a statement to the administrator of the fund setting forth the information described in paragraph g 3 of this section. The transferor must attach a copy of this statement to its return for the taxable year of transfer. If a disputed ownership fund has more than one transferor, any two or more transferors may provide a combined statement to the administrator.

If a combined statement is used, each transferor must attach a copy of the combined statement to its return and maintain with its books and records a schedule describing each asset that the transferor transferred to the disputed ownership fund.

The statement required by paragraph g 1 of this section must include the following information—. The following examples illustrate the rules of this section:. Inthe Tax Court determines that X Corporation is liable for an income tax deficiency for the taxable year. X Corporation files an appellate bond in accordance with section a and files a notice of appeal with the appropriate United States Court of Appeals. Although X Corporation was found liable for an income tax deficiency, ownership of the appellate bond is not disputed.

Rather, the bond serves as security for a disputed liability. Therefore, the bond is not a disputed ownership fund. X uses an accrual method of accounting. See paragraphs b 1 and c 1 ii of this section. See paragraph c 3 i of this section. See paragraphs b 7 and b 8 of this section. See paragraph f of this section. B uses an accrual method of accounting. The rental property is property used in a trade or business.

For several years, B has maintained and received the rent from the property.

On that date the court appoints R as receiver for the property. R collects the rent earned on the property and hires employees necessary for the maintenance of the property. The court also orders that a distribution be made to C of all funds held in the court registry consisting of the rent collected by R and the income earned thereon.

C takes title to the rental property. The fund is taxable as if it were a C corporation because the rental property is not a passive investment asset within the meaning of paragraph c 1 i of this section.

For the period between February 1,and June 1,the fund may be allowed deductions for depreciation and for the costs of maintenance of the property because the fund is treated as owning the property during this period. See sections, and Under paragraph c 4 ii of this section, the fund may not deduct the distribution to C of the property, or the rents or any income earned thereon collected from the property while the fund holds the property.

See paragraphs c 4 i and e 3 of this section. Under paragraphs b 8 and e 1 of this section, B is a transferor-claimant and does not recognize gain or loss under section a on transfer of the property to the disputed ownership fund.

The money and property distributed from the fund to C is deemed to be distributed first to B and then transferred from B to C. See paragraph e 3 ii of this section. Under paragraph e 2 i of this section, economic performance occurs when the disputed ownership fund transfers the property and any earnings thereon to C.

This section applies to disputed ownership funds established after February 3, With respect to a disputed ownership fund established after August 16,but on or before February 3,the Internal Revenue Service will not challenge a reasonable, consistently applied method of taxation for income earned by the fund, transfers to the fund, and distributions made by the fund.

MatthewsDeputy Commissioner for Services and Enforcement. Eric SolomonActing Deputy Assistant Secretary of the Treasury. Filed by the Office of the Federal Register on February 3,8: The principal authors of these regulations are Richard Shevak and A.

However, other personnel from the IRS and the Treasury Department participated in their development. Subscriptions IRS Guidewire IRS Newswire QuickAlerts e-News for Tax Professionals IRS Tax Tips More.

Escrow Funds and Other Similar Funds. Table of Contents AGENCY: Paperwork Reduction Act Background Explanation of Provisions and Summary of Comments Effect on Other Documents Effective Date Special Analyses Final Regulatory Flexibility Act Analysis Adoption of Amendments to the Regulations PART 1—INCOME TAXES PART — OMB CONTROL NUMBERS UNDER THE PAPERWORK REDUCTION ACT Drafting Information.

Explanation of Provisions and Summary of Comments. Effect on Other Documents. Final Regulatory Flexibility Act Analysis. Adoption of Amendments to the Regulations. PART — OMB CONTROL NUMBERS UNDER THE PAPERWORK REDUCTION ACT. Note Filed by the Office of the Federal Register on February 3,8: Know Your Rights Taxpayer Bill of Rights Taxpayer Advocate Accessibility Civil Rights Freedom of Information Act No FEAR Act Privacy Policy.

Treasury Treasury Inspector General for Tax Administration USA. More Internal Revenue Bulletins.