Cash dividends declared statement of retained earnings

The amount of net income which is left in a business after the distribution dividends or withdrawls by owner is called retained earnings.

Cash Dividend & Treasury Stock Dividend (With Restrictions on Retained Earnings As Reserve)It is calculated as shown in the following formula:. The financial statement which calculates the balance of retained earnings at the end of the period is called the statement of retained earnings.

It is very similar to the statement of changes in equity however it only shows how retained earnings changed during the period.

As obvious from the above formula, the basic elements of a statement of retained earnings are:. When dividends are declared in a period, they must be deducted in the statement of retained earnings of that period.

It does not matter whether the payment of dividend has been made or not. Written by Irfanullah Jan.

Contact Us Privacy Policy Disclaimer. It is calculated as shown in the following formula: As obvious from the above formula, the basic elements of a statement of retained earnings are: Beginning balance of retained earnings Corrections for prior errors along with the related tax effect Net income Dividends or withdrawals by the owner s if any When dividends are declared in a period, they must be deducted in the statement of retained earnings of that period.

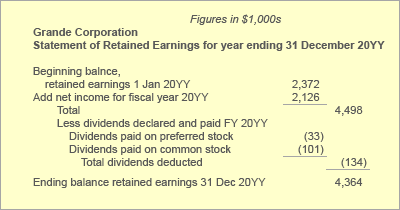

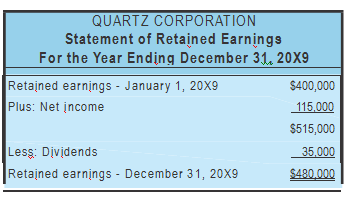

Example and Format The following example shows the format of a statement of retained earnings: Financial Accounting Financial Accounting Intro Accounting Principles Accounting Cycle Financial Statements Subsequent Events Cash and Cash Equivalents Receivables Inventories Other Current Assets Non-Current Assets Investments Revenue Recognition Employee Benefits Accounting for Taxes Lease Accounting Shareholders' Equity Current Liabilities Long-term Liabilities Partnership Accounting Business Combinations Financial Ratio Analysis Specialized Ratios Managerial Accounting Managerial Accounting Intro Cost Classifications Cost Accounting Systems Cost Allocation Cost Behavior Analysis Cost-Volume-Profit Analysis Relevant Costing Capital Budgeting Master Budget Inventory Management Standard Costing Performance Measurement Miscellaneous Time Value of Money Corporate Finance Forms of Business.

Current Chapter Financial Statements Income Statement Single-Step Income Statement Multi-Step Income Statement Income Statement by Nature Income Statement by Function Discontinued Operations Income Comprehensive Income Earnings per Share EPS Operating Segments Statement of Retained Earnings Balance Sheet Extraordinary Items Statement of Cash Flows Operating CF: Direct Method Operating CF: Indirect Method Investing Activities Cash Flow Financing Activities Cash Flow Statement of Changes in Equity Notes and Other Disclosures Manage.