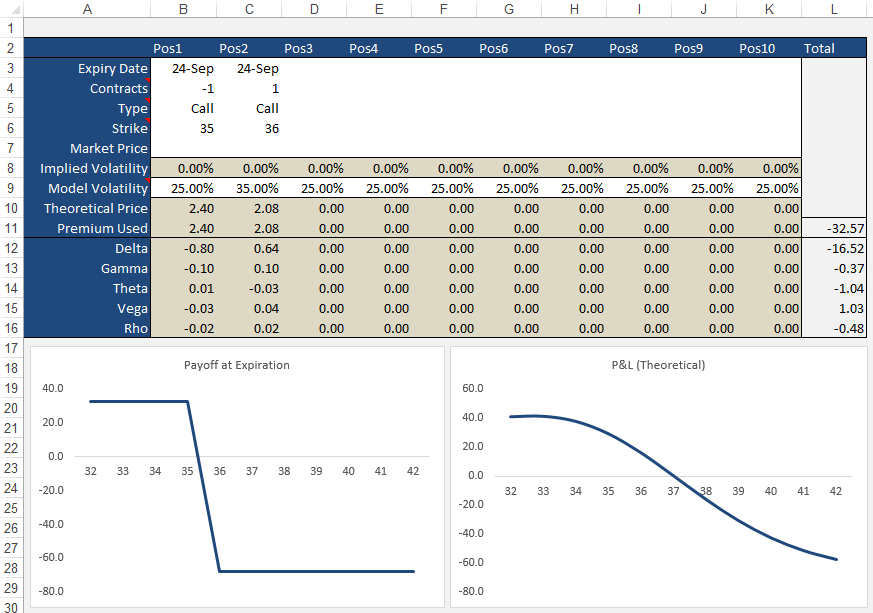

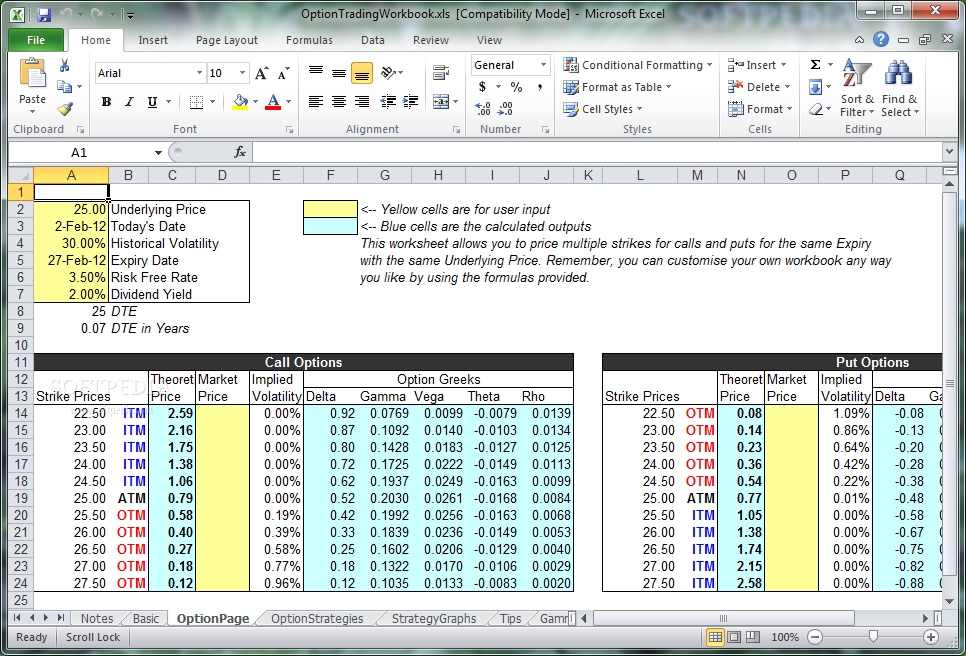

Options pricing spreadsheet

Compound Options - Introduction and Pricing Spreadsheet

And divide the extrinsic value by days to assess worth taking the trade. Strike Price pulled from external source CME futures source Premium pulled from external source CME futures source.

Intrinsic value in Pips calculated by formula Premium minus Strike price Extrinwic value in Pips calculated by formula Premium minus Intrinsic value.

Thanks for your valuable inputs and i respect you time and energy spent to develop the forumala and make it free in public domain, I like to know how to calculate the mispricing option formula.

Your email address will not be published. Skip to content Privacy Policy About Me Questions About The Spreadsheets?

Premium Excel Tools Kudos Baby. Business Analysis Portfolio Analysis Option Pricing Technical Trading Buy Spreadsheets Commentary.

June 8, at 5: Hi, is there an example of a one-touch binary option? August 26, at 9: Hi Samir, I am a beginner in Excel. I just need a spreadsheet to pull data from external source and just input Spot price or ATM value to calculate intrinsic value and extrinsic value. My intention is to split Premium of option into a intrinsic and b intinsic value to assess whether it is worth to go for a trade.

Can you help me figure out spreadsheet or just a formula for calculating pips for fx options: Five columns Spot price fixed for all selected bottom rows to be input by hand Strike Price pulled from external source CME futures source Premium pulled from external source CME futures source Intrinsic value in Pips calculated by formula Premium minus Strike price Extrinwic value in Pips calculated by formula Premium minus Intrinsic value ATM 1.

September 5, at Dear Sir Thanks for your valuable inputs and i respect you time and energy spent to develop the forumala and make it free in public domain, I like to know how to calculate the mispricing option formula.

October 6, at 8: Do you have an Excel spreadsheet that will pull option pricing? Leave a Reply Cancel reply Your email address will not be published.

Option Pricing - Invest Excel

Please leave these two fields as-is: To be able to proceed, you need to solve the following simple math so we know that you are a human: Like the Free Spreadsheets? This site takes time to develop. This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.

Twitter Tweets by investexcel. European Options Jump Diffusion.

Extreme Spread and Reverse Extreme Spread Options. Credit Default Swap Calculator. Pricing Double Barrier Options.

Black Scholes Option Calculator

European Option Pricing with Trinomial Tree. Black-Scholes Option Price and Greeks in VBA. Price Bond Options with a Binomial Tree. Monte-Carlo Pricing of European Options. American Options with Single Dividend. Implied Dividend of a European Option.