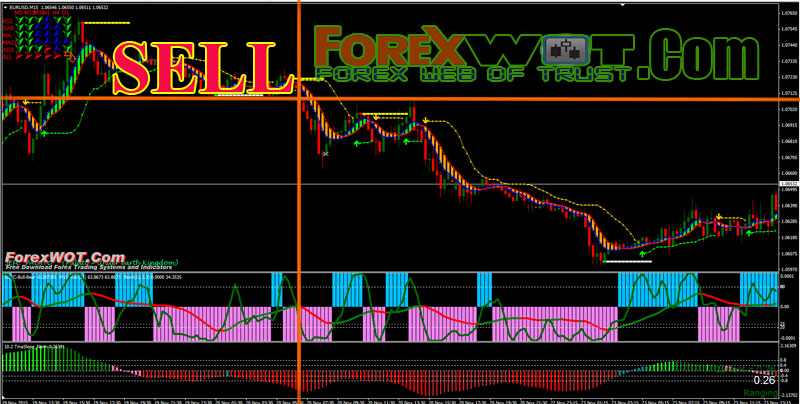

Forex bulls and bears indicator

Elder cleverly named his first indicator " Elder-ray " by virtue of its function, which is figuratively similar to that of x-rays.

Developed in , the Elder-Ray helps determine the strength of competing groups of bulls and bears by gazing under the surface of the markets for data that may not immediately be ascertainable at a mere superficial glance at prices. Here we take a look at this indicator. The Elder-Ray Understanding the Elder-ray is inextricably linked to an understanding of oscillators , which are figures used to find turning points in the markets.

Oscillators are seen to be indicative of the emotional extremes of both bulls and bears. These extremes are fleeting and unsustainable levels of optimism or pessimism that the vast majority of market participants are exhibiting. Knowing that these extreme conditions never last long, professional traders often fare better than average investors in betting against such extremes.

When the market rises and the bulls are greediest, the pros sell short. When the market is at its lowest and fear runs rampant, the pros jump in to buy. Elder-ray labels its oscillator components as "bull power" or "bear power".

These are combined with an exponential moving average , which is a trend-following indicator essential to the calculation. Bull power is a simple calculation, derived by subtracting an exponential moving average perhaps a day EMA of closing prices from a high price of any given security.

Bear power subtracts the EMA from the corresponding low price of that trading day. Both bull power and bear power are plotted as histograms under the bar chart of your chosen security.

Interpreting Elder Ray Now, how do we go about interpreting the Elder-ray and its inherent components? First, you may remember that price is a consensus of value for any given security at a particular point in time. The moving average is simply a consensus of value that is extended for a certain window of time.

The day EMA referenced earlier is the average consensus of value over the past 13 days. In interpreting the moving average, we are most concerned with its slope. When the slope rises, the crowd is becoming more bullish. When it falls, the crowd is more bearish. Clearly, the best course of action is to trade in the direction of the EMA. The high of the consensus of value occurs when bulls cannot lift prices any higher, thereby reaching their maximum power. And the low represents the lowest value to which the bears are capable of pushing the price, thereby reaching their maximum power.

So the low shown on the daily bar is the maximum power of bears for the day; on the weekly bar is their maximum power during the week, and so forth.

By measuring the distance from the bar's high to the EMA, bull power represents the capacity of bulls to push prices above the average consensus of value price. Bull power rises when bulls are stronger and falls when they are weaker, even becoming negative when they are utterly weak. Bear power, by contrast, is the capacity of bears to push prices below the moving average.

Top 3 profitable indicators for forex treadingThe distance between the low and the EMA, which widens when the bears are weaker and narrows when they are stronger, gives this figure. Bear Power is typically negative, so if it turns positive, the bulls have taken complete control. The corresponding sell signal is realized when prices hit a new high but bull power reaches a lower peak than that of its previous rally. Two additional conditions provide a stronger signal for shorting, but they are not absolutely essential:. In deciding when to cover short positions , it is important to interpret the time at which bear power indicates the weakness or strength of bears.

A new low in price with a new low in bear power points to a continued downtrend ; however, with bear power tracing a shallower bottom than prices, a bullish divergence is realized: The Bottom Line Divergences between bull or bear power and prices indicate the best trading opportunities.

Forex Trading Software < Track 'n Trade | Futures, Forex, Stocks Trading Software

The Elder-ray is an extremely accurate and effective means of identifying these opportunities. Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Seeing Into The Market By Jason Van Bergen Share. Here are the conditions essential for buying: The trend is up as indicated by EMA. Bear power is negative but rising. There are two additional conditions fine-tune the buying decision: Bull power's latest peak is higher than it was previously.

Bear power is moving higher from a bullish divergence. This situation provides traders with the strongest buy signal. For shorting, two conditions are absolutely necessary: The trend is down as indicated by EMA. Bull power is positive but falling.

Two additional conditions provide a stronger signal for shorting, but they are not absolutely essential: Bear power's latest bottom is deeper than any previous bottom. Bull power is declining from a bearish divergence.

As in the case of buying, the strongest signals for shorting are rendered by bearish divergences between bull power and prices.

Elder Ray Bull and Bear power Oscillators — MahiFX

How can a trader use the Elder-Ray oscillator as the second screen of this system? Discover why it's important to know the characteristics of the two types of market conditions. Find out how to use it as the second screen in this triple-screen system.

Pin Bar Indicator MT4 (DOWNLOAD LINK)

Here are the guidelines for making trading decisions using the force index in both a short and intermediate perspective. Learn how to measure the power of bulls behind rallies and bears behind declines. There are many ways to profit in both bear and bull markets. The key to success is using the tools for each market to their full advantage. Bull and bear markets shouldn't really matter to long-term investors.

Even if the market is in a decline your portfolio doesn't have to be. Read about the important buying and selling conditions that are recommended by Dr. Alexander Elder when using his Elder-Ray Learn about the Elder-Ray index, a novel technical oscillator created by Dr. Alexander Elder to assess the buying and selling Utilize the Elder-Ray index to create a forex trading strategy that can be used at potential market turning points where Discover which technical indicators best complement the Elder-Ray index, a momentum oscillator that measures the relative The terms bull and bear are used to describe general actions and attitudes, or sentiment, either of an individual bear and An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.