How did speculation and buying on margin contribute to the stock market crash

No ad for bid response id: Cannot find ad by given id: Go Log In Sign Up. What would you like to do? How did buying stocks on margin contribute to the stock market crash? Would you like to merge this question into it?

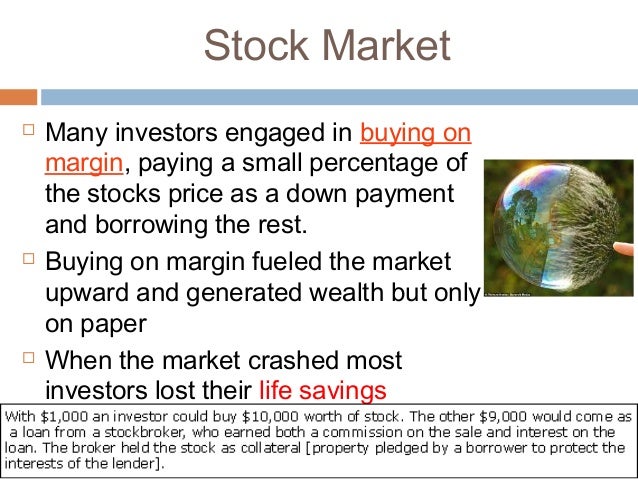

Would you like to make it the primary and merge this question into it? Merge this question into. Split and merge into it. Edit Answer by Kenneth Mason. You could buy stock without paying full price for it. People over bought, inflated prices and didn't have the money to pay for the stock when the time came to put up the cash.

The housing market was some what the same. Was this answer useful? Retired professor of math and computer science having taught for 36 years at a state supported university in Virginia.

You have to be a broker with a seat on the exchange to trade stocks on the stock exchange. You can get such a broker to buy and sell for you, but he will charge a commission.

In short, a person is buying with money they do not have, but are borrowing from their broker. A person does that so as to buy more of a stock they believe will go up in value ….

Stock Market Speculation in the 1920'qoxoxoxiqel.web.fc2.com4A broker does this because he assumes that the person has more information on this than he does, and wants to make money, too. However, not all stocks go up in value, some decline. And then the person and broker are compelled to sell what stocks they have to cover the losses.

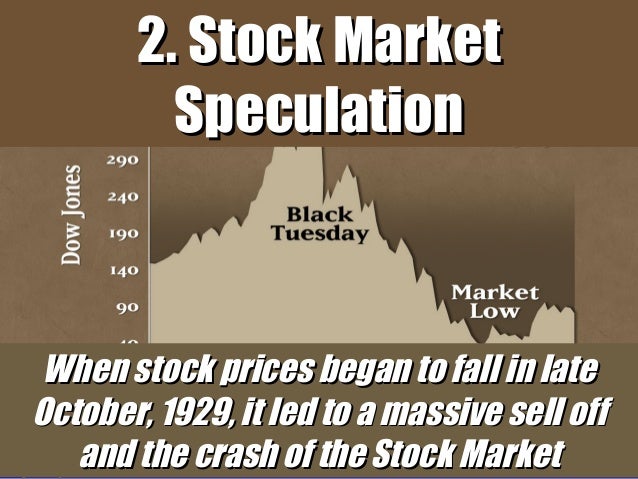

If stock prices were already going down across the board, the dumping of another amount of stocks on to the market exacerbates this downward trend.

The above answer is very short, very simplistic and very generalized - I know, I'm the one who just wrote it. It will do for general purposes. For greater detail, google "margin" or consult a competent financial analyst in your area. So long as you are simply asking for information purposes, there are probably some college economic professors or local bankers who'd be more than happy to assist.

Has the U.S. Gone Stock Market Mad? Here's What Happened Leading Up to & Beyond - munKNEE qoxoxoxiqel.web.fc2.com

In Investing and Financial Markets. Because billions of dollars were lost, whole fortunes were wiped out in hours, many speculators who had bought stock on margin lost everything they had, and it caused contract … ions towards the money supply in the economy. I am an Army veteran who has worked in the graphic arts, photography, transportation and retail industries.

Margin means you're borrowing money to buy stock. It's also one of the few ways you can lose more in the stock market than you invested in the first place.

It does that every 10 or 20 years, but the famous one was onOctober 29, I am a perpetual student who strives to learn more everyday to improve my teaching skills.

As a special education teacher, becoming creative to help a student learn a skill often requires unusual techniques. Categories you should follow. Log in or Sign Up to follow categories. What age buys teddy bears the most? How do i use a plot in a sentence?

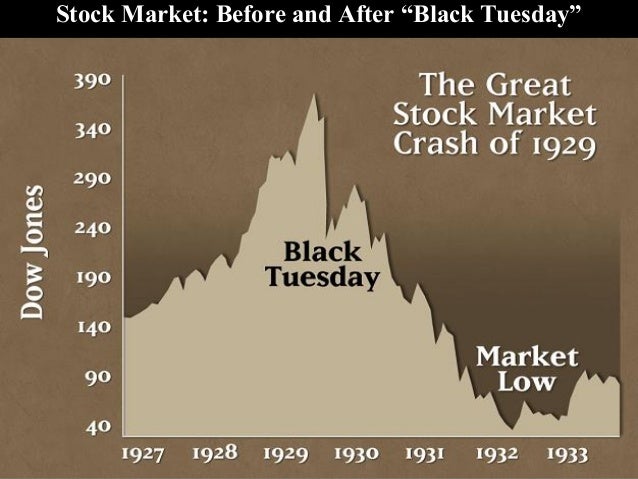

What conversion can take place in a transformer? How do you do a wall squat? Here are the ten worst one-day drops in the Dow Jones Industrial Average: October 19, "Black Monday" , October 28, , October 29, "Black Tuesday" … , November 11, , December 18, , August 12, , March 14, , October 26, , October 15, , July 21, , The most recent crash, in October , was spread over several days; only one of them appears in the top ten, above.

The "Tech Bubble" or "Dot-com Bubble" deflated a bit more slowly in ; the worst drop during that period was September 17, , with a drop of The stock market crash actually taught a valuable lesson to all investors. The lesson is that, don't keep all your eggs in the same basket.

Investopedia - Sharper Insight. Smarter Investing.

Because of the great bull run in th … e days before the crash, people were so confident of the stock market that they felt it would never crash. So people invested even their retirement corpus and other money into the stock market.

Unfortunately when it crashed, the whole economy burned. So the lesson is, keep your investments in different asset classes and have exposure to debt and other fixed income instruments too.

Different lessons could be learned from the different crashes that have occurred. From the crash, one of the lessons was not to use too much leverage in making one's investments borrowing too much on margin. From the market crash one of the lessons was to avoid bubble stocks as in that particular cash tech stocks.

From the crash one of the lessons was to not trust the banks nor the government. Each crash actually teaches us different lessons. My favorite lesson though all of the crashes has been to make sure you always have a nice fat cash reserve to buy with when everyone else is selling and to build that cash reserve when everyone else is buying.

Choose a video to embed.