Quantitative trading strategies forex

Quantitative trading consists of trading strategies based on quantitative analysiswhich rely on mathematical computations and number crunching to identify trading opportunities. As quantitative trading is generally used by financial institutions and hedge fundsthe transactions are usually large in size and may involve the purchase and sale of hundreds of thousands of shares and other securities.

However, quantitative trading is becoming more commonly used by individual investors. Quantitative trading techniques include high-frequency tradingalgorithmic trading and statistical arbitrage.

These techniques are rapid-fire and typically have short-term investment horizons.

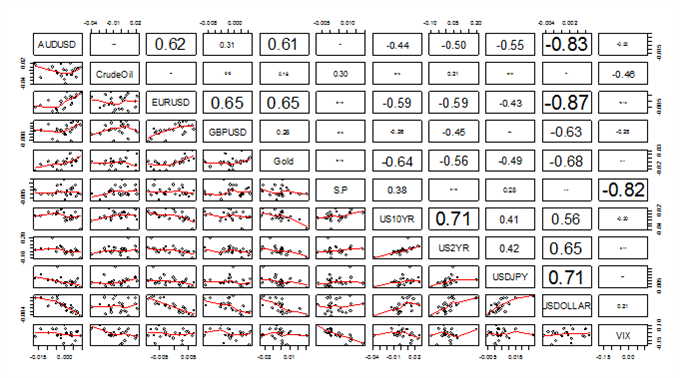

Many quantitative traders are more familiar with quantitative tools, such as moving averages and oscillators. Quantitative traders take advantage of modern technology, mathematics and the availability of comprehensive databases for making rational trading decisions. Quantitative traders take a trading technique and create a model of it using mathematics, and then they develop a computer program that applies the model to historical market data.

The model is then backtested and optimized. If favorable results are achieved, the system is then implemented in real-time markets with real capital.

Quantitative Forex Strategies vs. The Idiocies of Human Nature: Using One to Help The Other

The way quantitative trading models function can best be described using an analogy. The meteorologist derives this counterintuitive conclusion by collecting and analyzing climate unemployment stock options from sensors throughout the area.

A computerized quantitative analysis reveals specific patterns in the data. Quantitative traders apply this same process to financial market to make trading decisions. The objective of trading is to calculate the optimal probability of executing a profitable trade. A typical trader can effectively monitor, analyze and make trading decisions on a limited number of securities before the amount of incoming data overwhelms the decision-making process. The use foto su forex costo quantitative trading techniques illuminates this limit by using computers to automate the monitoring, analyzing, and trading quantitative trading strategies forex.

Overcoming emotion is one of the most pervasive problems with quantitative trading strategies forex. Be it fear or greed, when trading, emotion serves only to stifle rational thinking, which usually leads to losses. Computers and mathematics do not possess emotions, so quantitative trading eliminates this black swan stock market. Quantitative trading does have its problems.

Financial markets are some of the most dynamic entities that exist. Therefore, quantitative trading models must be as dynamic to be consistently successful. Many quantitative traders develop models that are temporarily profitable for the market condition for which they were developed, but they ultimately fail when market conditions change.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Quantitative forex trading strategies # qoxoxoxiqel.web.fc2.com

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. What is 'Quantitative Trading' Quantitative trading consists of trading strategies based on quantitative analysiswhich rely on mathematical computations and number crunching to identify trading opportunities. Understanding Quantitative Trading Quantitative traders take advantage of modern technology, mathematics and the availability of comprehensive databases for making rational trading decisions.

Advantages and Disadvantages of Quantitative Trading The objective of trading is to calculate the optimal probability of executing a profitable trade. Quantitative Analysis Quantitative Easing Quant Fund Qualitative Analysis Local Volatility Mathematical Economics Quantitative Easing 2 — QE2 Statistical Arbitrage Market Dynamics. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.