Compute implied volatility options

If you're seeing this message, it means we're having trouble loading external resources on our website. To log in and use all the features of Khan Academy, please enable JavaScript in your browser. Math by grade K—2nd 3rd 4th 5th 6th 7th 8th. Computing Computer programming Computer science Hour of Code Computer animation.

Test prep SAT MCAT GMAT IIT JEE NCLEX-RN CAHSEE.

Finance and capital markets Options, swaps, futures, MBSs, CDOs, and other derivatives. Introduction to the Black-Scholes formula. Google Classroom Facebook Twitter Email.

In the last video, we already got an overview that if you give me a stock price, and an exercise price, and a risk-free interest rate, and a time to expiration and the volatility or the standard deviation of the log returns, if you give me these six things, I can put these into the Black-Scholes Formula, so Black-Scholes Formula, and I will output for you the appropriate price for this European call option.

So it sounds all very straightforward, and some of this is straightforward. The stock price is easy to look up. The exercise price, well, that's part of the contract.

Calculating Implied Volatility in Excel - Macroption

The risk-free interest rate, there are good proxies for it, money market funds, there's government debt, things like that, so that's pretty easy to figure out, or at least approximate. The time to expiration, well you know that, you know what today's date is. You know when this thing's going to expire, so that's pretty straightforward. Now let's think a little bit about volatility, so how do you actually measure the standard deviation of log returns.

Now, one of the assumption about Black-Scholes Formula is that this is a constant thing.

What is an option's implied volatility and how is it calculated? | Investopedia

This is just some intrinsic propety of this security. Well, the only way that you can at least attempt to estimate it is by looking at the history of the standard deviation of log returns.

Calculate Implied Volatility in Excel

The way that people would normally do it is they'll say, "Okay, what has historically been "the standard deviation of log returns over some time period "where that security has not changed in some dramatic way?

Well, that's all interesting, but it's very important to know that this is an estimate. This right over here is an estimate.

Don't Trade Options Blind - Know Your Implied VolatilityThere's no way of us actually knowing the actual intrinsic and it's even up for grabs whether there is, whether you can even as assume that there's some constant intrinsic property as this volatility that's going to be constant over the life of this option.

So this is just an estimate. It's important to know that. But what is interesting is that these things are being traded. These call options are being traded all of the time, and so you could actually look up the price of this call option. You could look up a call option with this stock price, this exercise price. You know what these two things are, and you could say, "Hey, look.

If you know exactly what this is because you know what the market is pricing this at, so let me write this. You know what the market believes this price should be, so the market belief, and it's based on their actual transcations, so it's based on transactions. This is what the market is saying the correct price is. You can figure that out, you can just look that up.

You can figure out all of this other stuff. Can you then take this output plus all of these to work backwards through Black-Scholes to figure out what the market is guessing about this, or what the market is estimating about that.

The answer is yes. This is where this whole idea about when people talk about what is the volatility in the market, or even where are carton volatility rates, or even what does the market expect volatility to be? How do we know what the market expects volatility to be? Well, we can look at what markets are trading options at. We could look at all of this other information that would be inputted into Black-Scholes equation, and we can say, "Hey, look.

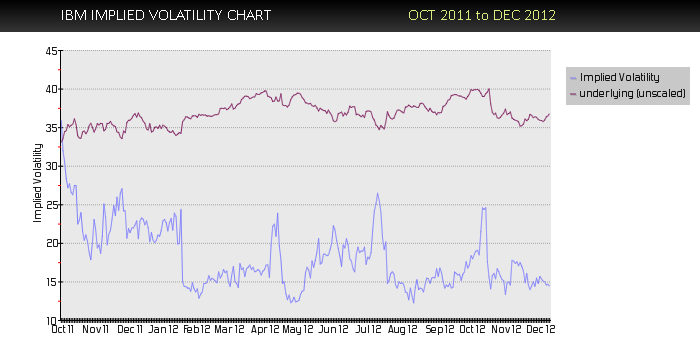

The market becomes a lot dicier and choppier. Well then, people are gonna pay more for this option. It's gonna drive the implied volatility up. So when you hear people talk about implied volatility, or implied vol, and there are even people who will actually trade on implied volatility, This is what they're talking about.

Implied Volatility

Options are trading all the time. We can look these things up, but based on what the market is trading these options at, can we figure out what the implied volatility, what the implied market belief about volatility for that security is, and then we can actually aggregate it across many, many securities, and come up with an implied volatility for given markets at a time.

So it's a very, very, very interesting idea, but in some levels, it's kind of a basic one. You're just working backwards through Black-Scholes.